updated, February 22, 2025 -The link between adults with sleep deprivation and postpartum depression has been proven over and over. According to the Sleep Research Society, women report “the highest levels of anxiety and depressive symptoms in early pregnancy and the lowest levels of social support.” Hormonal shifts are normal and expected after your newborn arrives but they should be monitored. This blog Sleep Deprivation and Postpartum Depression: Proven Tips to Help, describes actionable tips to increase your sleep and sleep quality.

Use these tips to keep normal post-baby mood shifts from elevating into depression.

More Than Mom: Depression Affects the Family

It’s important to note that the link between sleep and poor mental health outcomes affects not only the birthing mother, but the overall health of the family and community as well.

Here’s what we mean:

- Babies: Those experiencing postpartum depressive symptoms were less likely to place infants in safe sleeping positions. Additionally in the first 2 years of life, babies sleep patterns are affected by their mothers. Babies whose mothers slept less, also receive less sleep themselves, adversely affecting infant health.

- Partners: Sleep problems can also contribute to the transmission of depression within a couple. “Mothers’ and fathers’ depressive symptoms were correlated with each other…” Further depression is associated with more depressive symptoms for both partners at all three assessments.

- Family and Community: Accidents, specifically automobile accidents are also more likely due to drowsy driving. This is true for anyone who’s sleep deprived, not just new parents.

Sleep Deprivation and Postpartum Depression: Proven Tips to Help

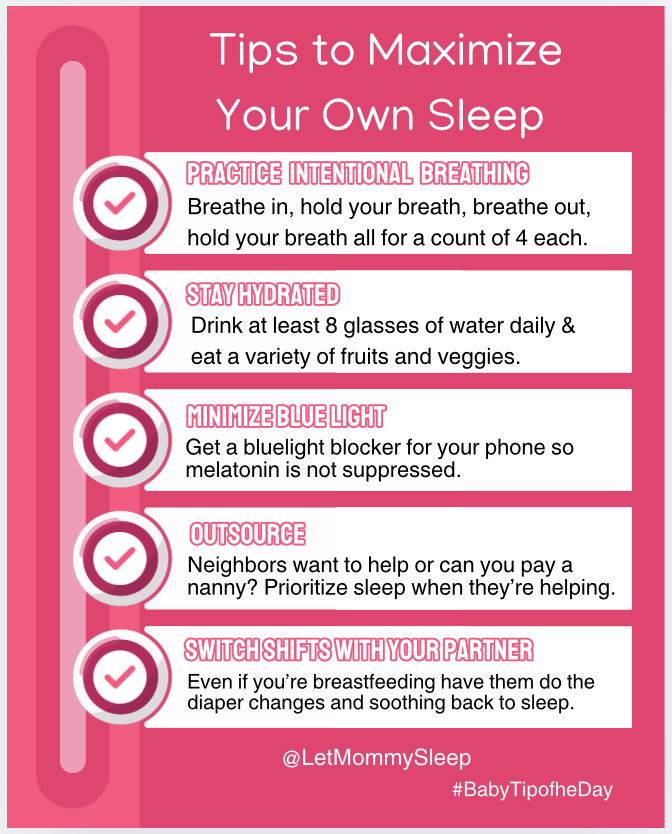

Practice Good Sleep Hygiene…when you can!

Basic sleep hygiene is a great foundation for sleep for everyone. As a parent of a newborn, you may not be able to do all of these activities but try to include as many as possible into your day:

- Be consistent: This is the hardest of course but when you can, go to bed at the same time each night and get up at the same time each morning.

- Have a good set-up: your bedroom should be quiet, dark, relaxing, and at a comfortable temperature.

- Remove electronic devices: Remove the temptation to watch TV, use a computer and scroll your phone. Blue light from tablets, phones and computers suppresses the production of melatonin. Melatonin is a natural hormone released in the evening to help you feel tired and ready for sleep.

- Keep your diet in check: Avoid large meals, caffeine, and alcohol before bedtime.

- Try to get exercise: Being physically active during the day can help you fall asleep more easily at night.

How to Switch Gears from Awake to Sleepy

For many of us, the feeling of being “on” as a new parent and the adrenaline that comes with it hinders our natural sleep cycles. So we can’t sleep when we’re supposed to because our bodies are trained to be on alert for baby’s needs. To help your brain switch gears into sleep mode, you can try mindful meditation like this:

- Find a quiet area. Sit or lie down, depending on what feels most comfortable. Lying down is preferable at bedtime.

- Close your eyes and breathe slowly. Inhale and exhale deeply. Focus on your breathing.

- If a thought pops up, let it go and refocus on your breathing.

It’s okay if it’s hard to practice the steps above. You can also use a meditation app like Calm or Insight Timer that are free or low-cost. They can help your brain switch from alert to calm.

Divide and Conquer!

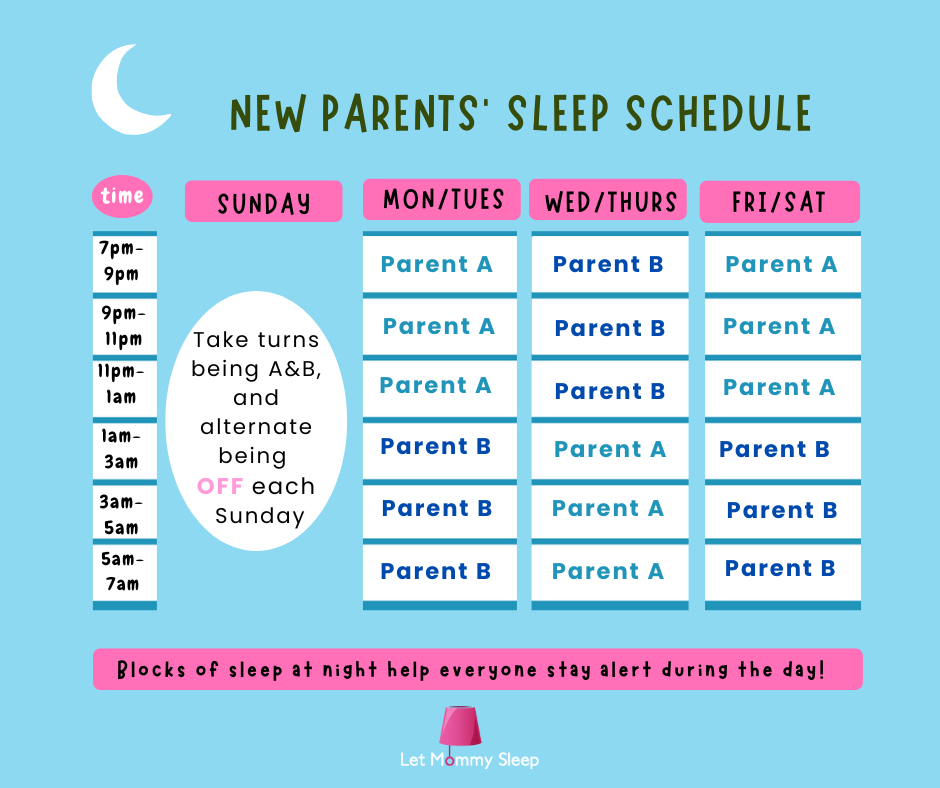

This is the easiest and most effective way for both of you to get sleep! Make sure you dedicate times during the night, or even nights of the week where each of you receives uninterrupted blocks of sleep.

Here’s how:

Swap night time care duties with your partner – You can care for baby in shifts. Parent A is on from 9pm – whenever baby gets up overnight, then parent B is on from the end of that wake-up til morning. Better yet, do a 3 nights on/3 nights off schedule. You may miss your partner but remember this routine it is only temporary. You’ll lower your risk of postpartum depression and keep your immune system strong by getting blocks of deep. restorative sleep.

What if I’m Nursing?: Babies do the same things overnight that they do during the day, so splitting duties makes sense when breastfeeding. In other words, if you’re breastfeeding, keep your newborn in a bassinet next to the bed close so you stay in bed to nurse while your partner does the diaper changes and soothing back to sleep when you’re done nursing. You’ll still wake up to nurse but your partner will be the adult who is “on” for all other needs. After the first 6 weeks, when your infant naturally becomes much more wakeful, taking turns being “off” overnight becomes crucial as your baby will sometimes be up for hours at a time through the night.

Outsourcing– If your budget allows, hiring help to care for baby, clean your home or deliver groceries can be the difference between the ability to nap and the sleep deprivation. Here are some ways to make postpartum night doulas or night nurse service more affordable.

Sleep Deprivation and Postpartum Depression: Proven Tips to Help – Have a Plan & Preps Before Baby Arrives

We’ve all heard that we should meal plan and try to outsource household tasks. And the reason we’ve all heard it is because it’s really great advice! Here is a detailed list of preps your first weeks home so you aren’t tempted to use sleep time on everyday tasks:

- Freeze your favorite ready-to-eat foods before baby arrives.

- Have a “go-to” list. Write down the top 5 items or tasks that need to be done consistently. Laundry, wiping down the counters, vacuuming, running to the store for food, diapers and wipes…whatever you might need. Then when a neighbor or friend asks what can I do?, hand them the task list and empower them to do what’s needed.

- If you have a toddler or older child, stash away a few surprises for them like a favorite treat or inexpensive toys. There will be a time when the newborn needs your attention, taking you away from your toddler. This is when you can whip out a special treat for the toddler to show them you’re always thinking of them even when you’re caring for their baby sibling.

- If you have trusted adults close by that can help, put them on a schedule. Knowing that Grandma always comes on Mondays for example, means you can predictably plan outings, appointments and down time.

- Have the tough conversation with your partner about who-does-what when your baby arrives. If you’re nursing it’s especially important that someone takes care of you while you take care of the baby. Some topics to consider might be: do you both have family leave? Neither of you? Is there family close by who can step in periodically? How will you divide overnight newborn care? What about jobs around the house? Clear expectations of both of you at the beginning make adjustments down the road easier and ensure neither of you are carrying more than your fair share.

More information

This article was presented by Let Mommy Sleep of Las Vegas at the Nevada Maternal and Child Health Coalition’s mental health symposium. If you ever have questions or need overnight support, contact us here. And if you’re having thoughts that scare you, call or text 988, or contact the National Maternal Health Hotline at 833-TLC-MOMS. It’s important to know that postpartum depression is always treatable.

If you’re expecting and want more tips, sign up to receive our free newborn and postpartum support guide.